Harish joined the Business Development team at Integrum ESG after having previously overseen BD for the investment network Venture Giants, and also worked within the Customer Experience Program Team at Amazon. He has a BSc in Philosophy, Logic and Scientific Method from the London School of Economics and Political Science.

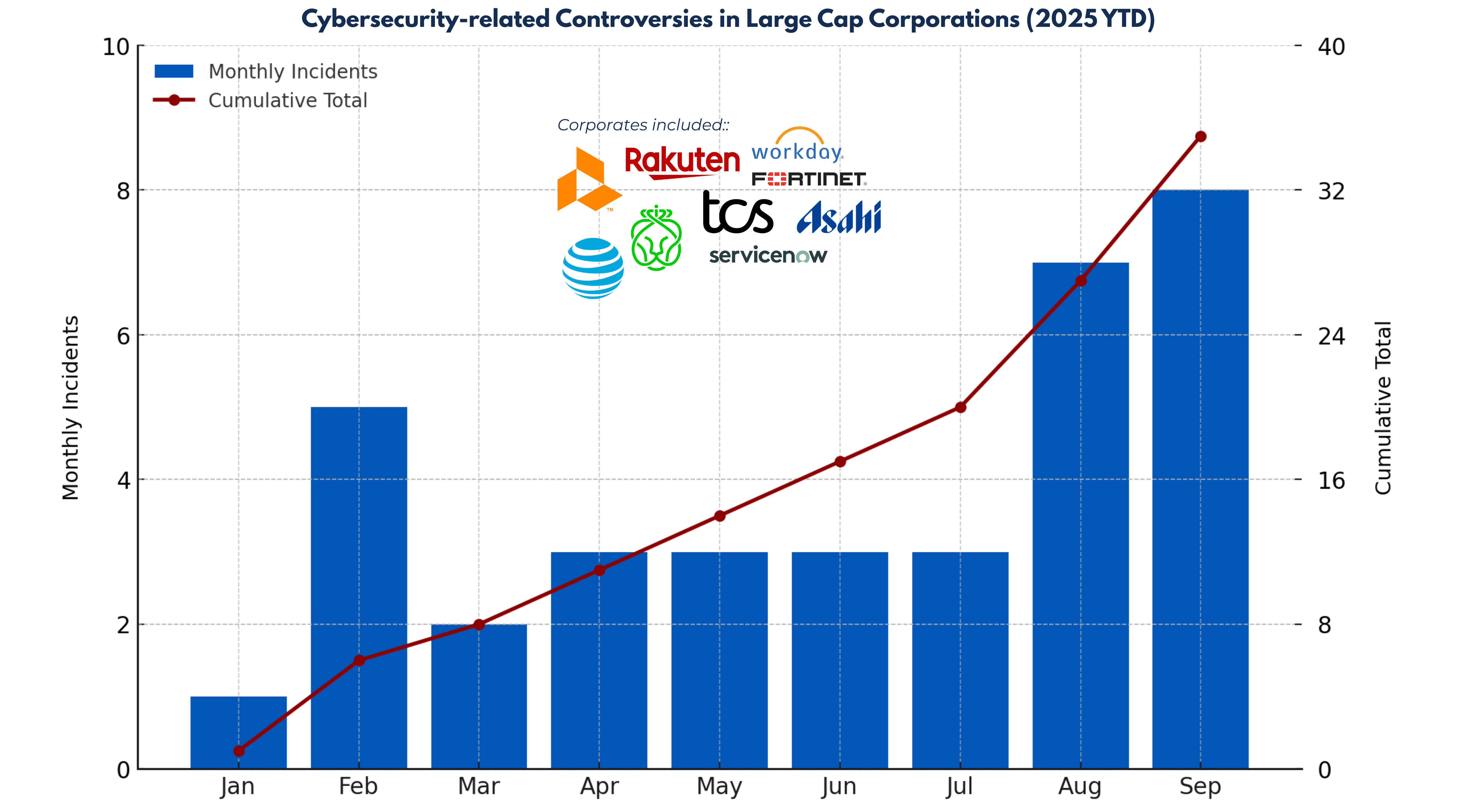

Cybersecurity controversies are accelerating across global markets. In the first nine months of 2025, 35 major global companies were flagged for incidents involving hacks, breaches, ransomware and phishing.

Together, these firms represent more than $1.7 trillion in market value, with an average market cap of $49 billion.

What happened?

Using the Integrum ESG sentiment tracker, our team identified and catalogued cybersecurity controversies between January 1 and September 30 2025. Some key findings include:

• 35 companies flagged during the period

• Combined market cap: $1,713,529,522,787

• Average market cap: $48,957,986,365

• September spike: 8 incidents in a single month, the highest this year

High-profile names flagged include Adobe, SAP, Fortinet, Tesco, AT&T, Juniper Networks, Rakuten, Volvo Group and more.

Why this matters for investors

This rising trend shows that cybersecurity controversies are becoming a recurring feature of global markets.

For asset managers, hedge funds and institutional investors, the implications are significant:

• Broad exposure

Major companies across technology, telecoms, consumer goods and financial services are all being affected, making it difficult to diversify away from the risk.

• Operational disruption

Cyber incidents can interrupt core business functions, delay client services and create costs that flow directly to the bottom line.

• Governance pressure

Boards and executives face scrutiny when controls are weak, exposing firms to reputational damage and regulatory intervention.

• Financial performance

Lawsuits, fines and erosion of customer trust translate into measurable impacts on revenue, valuation and long-term investor returns.

Key Takeaways

• Cybersecurity controversies are increasing - 35 incidents flagged across global companies in 2025 so far, with a sharp rise in September

• Scale of exposure is systemic - affected companies represent over $1.7 trillion in market value

• Investors need real-time monitoring - cyber controversies are financial risks that must be tracked alongside other ESG factors

How Integrum tracks cybersecurity controversies in real time

At Integrum ESG, we equip investors with the data and intelligence needed to identify ESG controversies early.

Our Platform combines transparent, credible and auditable ESG analytics with a real-time ESG sentiment and controversies tracker. Powered by AI, it monitors over 47,000 news and social media sources to detect when sentiment around a company’s ESG performance is shifting.

By flagging governance, conduct and compliance risks before they escalate into full controversies, Integrum helps investors avoid exposure to reputational damage, regulatory penalties and value erosion across their portfolios.

ESG Intelligence which is fast, transparent and affordable - only on the Integrum Platform.